optimal bid

Optimal day-ahead bidding strategy with futures and bilateral contracts. Scenario generation through factor models

Wed, 07/21/2010 - 15:14 — admin| Publication Type | Conference Paper |

| Year of Publication | 2010 |

| Authors | Cristina Corchero; F.-Javier Heredia; M.-Pilar Muñoz |

| Conference Name | 24th European Conference on Operational Research |

| Conference Date | 11-14/07/2010 |

| Conference Location | Lisboa |

| Type of Work | Invited Presentation |

| Key Words | research; electrical markets; stochastic programming; forecasting |

| Abstract | We propose a stochastic programming model that gives the optimal bidding, bilateral (BC) and futures contracts (FC) nomination strategy for a price-taker generation company in the MIBEL. The objective of the study is to decide the optimal economic dispatch of the physical FC and BC among the thermal units, the optimal bidding at day-ahead market (DAM) abiding by the MIBEL rules and the optimal unit commitment that maximizes the expected profits from the DAM. For the uncertainty characterization, we apply the methodology of factors models to forecast market prices in a short-term horizon. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Combined Cycle Units in the Day-ahead Electricity Market with Bilateral Contracts

Fri, 05/28/2010 - 09:58 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2009 |

| Authors | Heredia, F.-Javier; Rider, Marcos.-J.; Corchero, C. |

| Conference Name | 2009 Power Engineering Society General Meeting |

| Pagination | 1-6 |

| Conference Start Date | 26/07/2010 |

| Publisher | IEEE |

| Conference Location | Calgary |

| ISSN Number | 1944-9925 |

| ISBN Number | 978-1-4244-4241-6 |

| Key Words | research; Electricity spot-market; bilateral contracts; combined cycle units; optimal bidding strategies; short-term electricity generation planning; stochastic programming; paper |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/PES.2009.5275680 |

| Export | Tagged XML BibTex |

Optimal Bidding Strategies for Thermal and Generic Programming Units in the Day-Ahead Electricity Market

Fri, 03/19/2010 - 16:00 — admin| Publication Type | Journal Article |

| Year of Publication | 2010 |

| Authors | Heredia, F.-J; Rider, M.-Julio; Corchero, C. |

| Journal Title | IEEE Transactions on Power Systems |

| Volume | 25 |

| Issue | 3 |

| Pages | 1504-1518 |

| Start Page | 1504 |

| Journal Date | Aug. 2010 |

| Publisher | IEEE Power & Energy Society |

| ISSN Number | 0885-8950 |

| Key Words | research; paper; bilateral contracts; electricity spot market; optimal bidding strategies; short-term electricity generation planning; stochastic programming; virtual power plant auctions |

| Abstract | This study has developed a stochastic programming model that integrates the day-ahead optimal bidding problem with the most recent regulation rules of the Iberian Electricity Market (MIBEL) for bilateral contracts (BC), with a special consideration for the new mechanism to balance the competition of the production market, namely virtual power plant (VPP) auctions. The model allows a price-taking generation company (GenCo) to decide on the unit commitment of the thermal units, the economic dispatch of the BCs between the thermal units and the generic programming unit (GPU), and the optimal sale/purchase bids for all units (thermal and generic), by observing the MIBEL regulation. The uncertainty of the spot prices has been represented through scenario sets built from the most recent real data using scenario reduction techniques. The model has been solved using real data from a Spanish generation company and spot prices, and the results have been reported and analyzed. |

| URL | Click Here |

| DOI | 10.1109/TPWRS.2009.2038269 |

| Export | Tagged XML BibTex |

Improving electricity market price scenarios by means of forecasting factor models

Tue, 09/01/2009 - 14:47 — admin| Publication Type | Conference Paper |

| Year of Publication | 2009 |

| Authors | M.-Pilar Muñoz; Cristina Corchero; F.-Javier Heredia |

| Conference Name | The 57th Session of the International Statistical Institute |

| Conference Date | 16-22/08/2009 |

| Publisher | International Statistical Institute |

| Conference Location | Durban, South Africa |

| Type of Work | Plenary session |

| Key Words | research; spot price forecasting; scenario generation; MIBEL |

| Abstract | In liberalized electricity markets, Generation Companies must build an hourly bid that is sent to the market operator. The price at which the energy will be paid is unknown during the bidding process and has to be forecast. In this work we apply forecasting factor models to this framework and study its suitability. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Lectura de dos PFC's a la DE sobre oferta òptima als mercats d'energia elèctrica.

Wed, 07/22/2009 - 16:25 — admin

El passat dijous 9 de juliol de 2009 es va llegir el Projecte Final de Carrera dels alumnes Silvia Nieto i Ivan Ruz, que portava per títol "Estudi i optimització de l’oferta al Mercat Ibèric ’Electricitat (MIBEL)", dirigit pel professor Javier Heredia. Els objectius del treball han estat:

- Fer una descriptiva de les dades obtingudes de les energies tèrmiques per veure el comportament que hi tenen.

- Entendre el model d'optimització d'oferta presentat a l'article [1], i compendre la seva implementació.

- Entendre el model d'optimització d'oferta de l'article [2] i resoldre una nova modelització adaptant aquest model a l'anterior fent els canvis pertinents.

- Comparar els dos models i treure'n conclusions sobre quin és el més eficient.

[1] Arroyo, José M. ; Carrión, Miguel. A computationally efficient mixed-integer linear formulation for the termal unit commitment problem. Institute of Electrical and Electronics Engineers transactions on power systems, vol. 21, nº3, agost 2006.

[2] "A Stochastic Programming Model for the Thermal Optimal Day-Ahead Bid Problem with Physical Futures Contracts", Submitted to European Journal of Operations Research, Barcelona, Espanya, Dept. of Statistics and Operations Research, Universitat Politècnica de Catalunya, 03/2009

A Stochastic Programming Model for the Thermal Optimal Day-Ahead Bid Problem with Physical Futures Contracts

Wed, 03/18/2009 - 17:25 — admin| Publication Type | Report |

| Year of Publication | 2009 |

| Authors | Cristina Corchero; F. Javier Heredia |

| Pages | 19 |

| Date | 03/2009 |

| Reference | Research Report DR 2009/03, Dept. of Statistics and Operations Research, E-Prints UPC http://hdl.handle.net/2117/2795, Universitat Politècnica de Catalunya |

| Prepared for | Accepted for publication at Computers and Operations Research |

| City | Barcelona, Spain. |

| Key Words | research; Stochastic programming; OR in energy; electricity day-ahead market; futures contracts; optimal bid |

| Abstract | The reorganization of the electricity industry in Spain completed a new step with the start-up of the Derivatives Market. One main characteristic of MIBEL’s Derivatives Market is the existence of physical futures contracts; they imply the obligation to settle physically the energy. The market regulation establishes the mechanism for including those physical futures in the day-ahead bidding of the Generation Companies. The goal of this work is to optimize coordination between physical futures contracts and the Day-Ahead bidding which follow this regulation. We propose a stochastic quadratic mixed-integer programming model which maximizes the expected profits, taking into account futures contracts settlement. The model gives the simultaneous optimization for the Day-Ahead Market bidding strategy and power planning production (unit commitment) for the thermal units of a price-taker Generation Company. The uncertainty of the day-ahead market price is included in the stochastic model through a set of scenarios. Implementation details and some first computational experiences for small real cases are presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Lectura d'una Tesi Final de Màster a l'FME

Thu, 03/05/2009 - 13:40 — admin

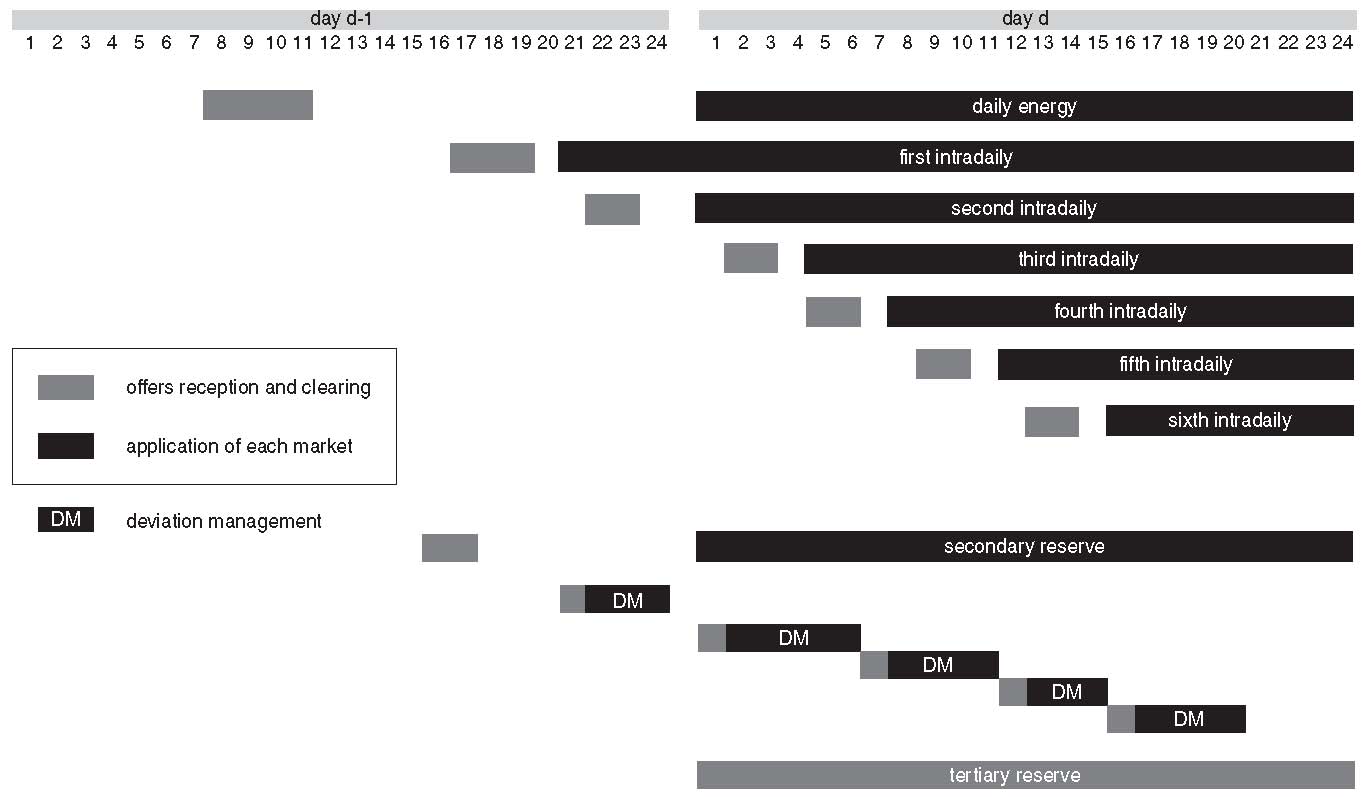

Dimecres 4 de març es va llegir a la Facultat de Matemàtiques i Estadística la Tesi Final de Màster d'Enginyeria Matemàtica de l'alumna Eva Romero i Beneyto, que porta per títol "Oferta òptima multi – mercat al Mercat Ibèric d’Electricitat", i que he tingut el plaer de dirigir. En aquest treball es proposa un nou model, basat en els treball de Plazas et al. i Heredia et al. , per a l'oferta òptima al mercat diari tenint en compte els mercats de secundària i intradiari. Clicant aquí obtindreu més informació .

Oferta òptima multi–mercat al Mercat Ibèric d'Electricitat.

Mon, 03/02/2009 - 18:25 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2009 |

| Authors | Eva Romero i Beneyto |

| Director | F.-Javier Heredia |

| Tipus de tesi | Tesi Final de Màster // MSc Thesis |

| Titulació | Màster en Enginyeria Matemàtica |

| Centre | Facultat de Matemàtiques i Estadística, UPC |

| Data defensa | 04/03/2009 |

| Nota // mark | 9 (over 10) E |

| Key Words | teaching; MEM; electricity market; multimarket; optimal offer; stochastic programming; MSc Thesis |

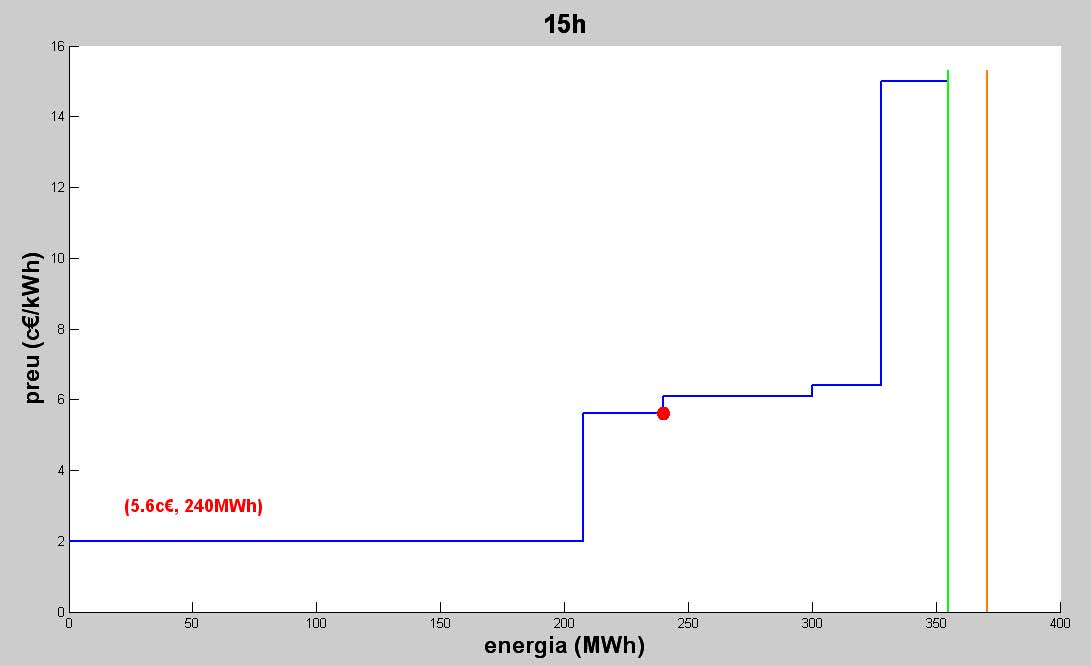

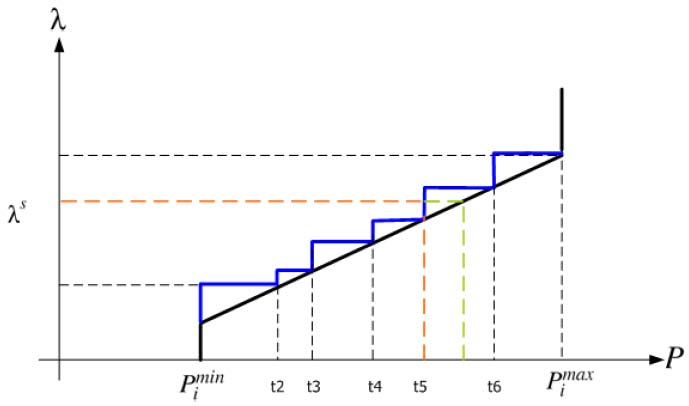

| Abstract | El present projecte analitza, estudia i desenvolupa diversos models multi - mercat estocàstics per al Mercat Ibèric d'Electricitat. A partir de l'artcile "Multimarket Optimal Bidding for a Power Producer" de Plazas et al, s'analitzen i es proposen diverses possibles millores: incorporació de costos quadràtics de generació i una nova definició de funció d'oferta. Aquestes millores es desenvolupen donant lloc un nou model competitiu amb l'anterior. Tenint en compte el reglament de MIBEL, i com a millora al primer proposat, finalment es desenvolupa un tercer model multi – oferta que contempla la definició de la funció d'oferta de forma esglaonada. Els resultats obtinguts mostren com la consideració de la determinació dels graons dins la pròpia modelització és rellevant respecte les funcions d'oferta obtingudes. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Optimal multimarket bid

Thu, 02/12/2009 - 18:13 — admin

Pla de treball:

Estudiar normativa mercat reserva (P.O. 7.2)- (CC) Modelització mercat de reserva: variables aleatòries rellevants-> arbres.

- (JH) Pensar com afecta secundària a l'oferta el mercat diari.