optimal bid

Optimal Bidding Strategies for Thermal and Generic Programming Units in the Day-ahead Electricity Market

Fri, 12/19/2008 - 10:57 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 12 |

| Date | 11/2008 |

| Reference | Research report DR 2008/13, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/2468. Universitat Politècnica de Catalunya |

| Prepared for | Published on august 2010 at IEEE Transactions on Power Systems |

| Key Words | research; stochastic programming; electricity markets; day-ahead market, bilateral contracts; Virtual Power Plants; optimal bid |

| Abstract | This paper develops a stochastic programming model that integrates the day-ahead optimal bidding problem with the most recent regulation rules of the Iberian Electricity Market (MIBEL) for bilateral contracts, with a special consideration for the new mechanism to balance the competition of the production market, namely virtual power plants auctions (VPP). The model allows a price-taker generation company to decide the unit commitment of the thermal units, the economic dispatch of the bilateral contracts between the thermal units and the generic programming unit (GPU) and the optimal sale/purchase bids for all units (thermal and generic) observing the MIBEL regulation. The uncertainty of the spot prices is represented through scenario sets built from the most recent real data using scenario reduction techniques. The model was solved with real data from a Spanish generation company and spot prices, and the results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Short- and Medium-Term Multimarket Optimal Electricity Generation Planning with Risk and Environmental Constraints (DPI2008-02153)

Fri, 11/07/2008 - 19:57 — admin| Publication Type | Funded research projects |

| Year of Publication | 2008 |

| Authors | F.-Javier Heredia |

| Type of participation | Project leader |

| Duration | 01/2009-12/2011 |

| Call | Proyectos de Investigación Fundamental no Orientada 2008. IV Plan Nacional de I+D+i (2008-2011) |

| Funding organization | Ministerio de Ciencia e Innovación, Gobierno de España |

| Partners | Unión Fenosa, Gas Natural, Universidad Politècnica de Catalunya, Universidad del País Vasco, Universidade Estadual de Campinas-UNICAMP, University of Edinburgh, Norwegian University of Science and Technology. |

| Full time researchers | 6 EDP |

| Budget | 157.300'00€ |

| Project code | DPI2008-02153 |

| Key Words | research; stochastic programming; electricity markets; risc; multimarket; environmental constraints; project; public; competitive; micinn; energy |

| URL | Click Here |

| Export | Tagged XML BibTex |

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and CC units

Thu, 10/09/2008 - 17:48 — admin

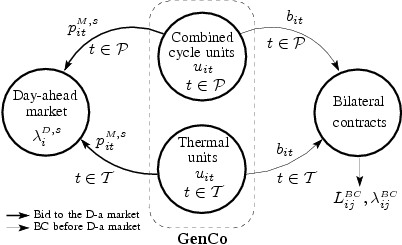

This work, co-authored by Dr. Marcos.-J Rider and Ms. Cristina Corchero and submitted to the journal Annals of Operations Research, developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. This model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the bilateral contracts between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. See the full text at http://hdl.handle.net/2117/2282

A stochastic programming model for the optimal electricity market bid problem with bilateral contracts for thermal and combined cycle units

Thu, 10/09/2008 - 17:27 — admin| Publication Type | Report |

| Year of Publication | 2008 |

| Authors | Heredia, F.-Javier, Rider, Marcos.-J., Corchero, C. |

| Pages | 18 |

| Date | 10/2008 |

| Reference | Group on Numerical Optimization and Modelling, E-Prints UPC, http://hdl.handle.net/2117/2282. UPC. |

| Prepared for | Accepted for publication in Annals of Operations Research (2011) |

| City | Barcelona |

| Key Words | combined cycle units; optimal bid; bilateral contracts; day-ahead market; electricity markets; stochastic programming; modeling language; research |

| Abstract | This paper developed a stochastic programming model that integrated the most recent regulation rules of the Spanish peninsular system for bilateral contracts in the day-ahead optimal bid problem. Our model allows a price-taker generation company to decide the unit commitment of the thermal and combined cycle programming units, the economic dispatch of the BC between all the programming units and the optimal sale bid by observing the Spanish peninsular regulation. The model was solved using real data of a typical generation company and a set of scenarios for the Spanish market price. The results are reported and analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |