electricity market

Ph D. Thesis on multistage scenario tree generation for renewable energies.

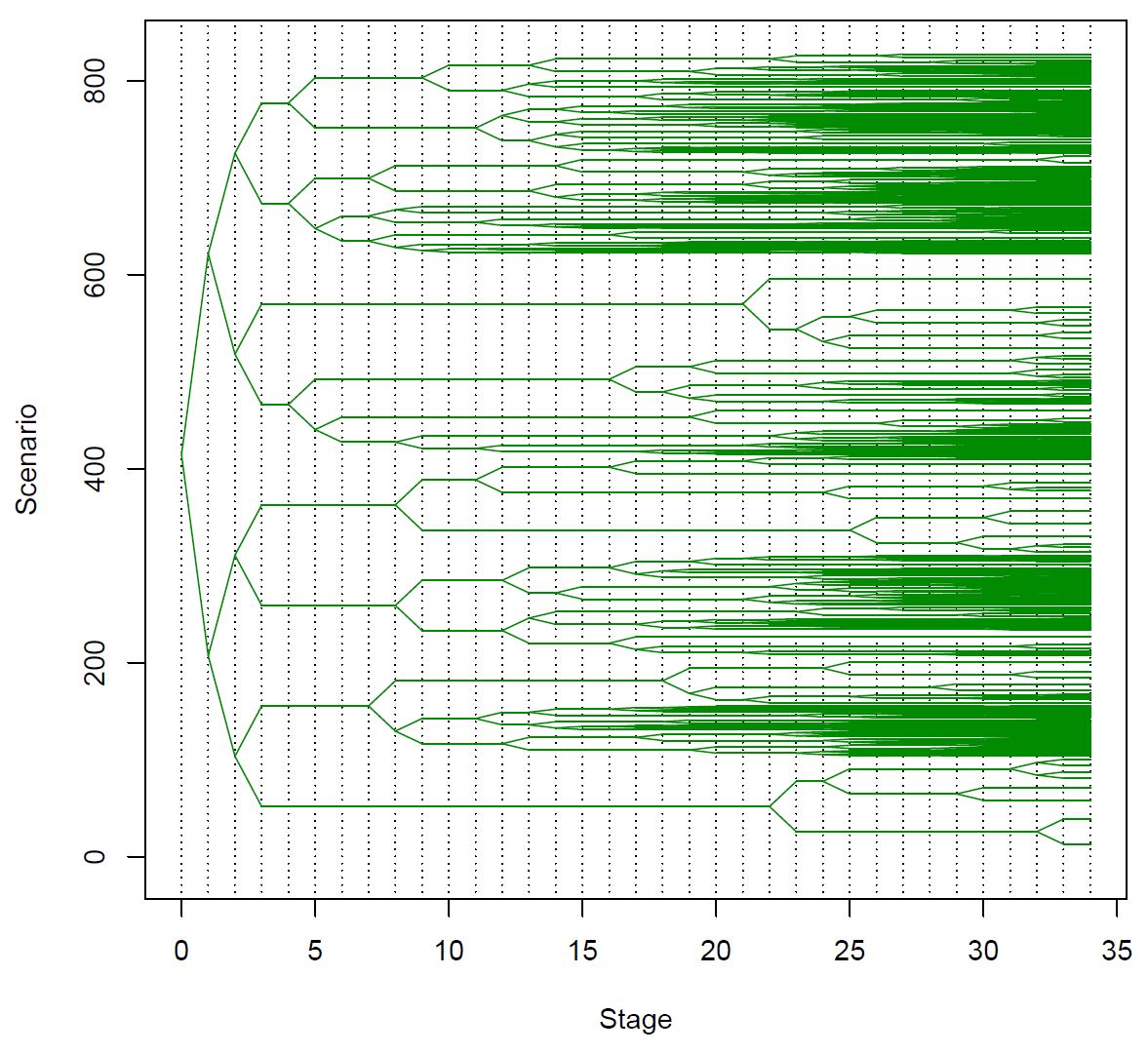

Mon, 11/30/2020 - 19:40 — admin On November 30th 2020 took place the defense of the Ph.D. Thesis entittled "Multistage Scenario Trees Generation for Renewable Energy Systems Optimization", authored by Ms. Marlyn D. Cuadrado Guevara and advised by prof. F.-Javier Heredia. In this thesis a new methodology to generate and validate probability scenario trees for multistage stochastic programming problems arising in two different energy systems with renewables are proposed. The first problem corresponds to the optimal bid to electricity markets of a virtual power plant that consists on a wind-power plant plus a battery storage energy systems. The second one is the optimal operation of a distribution grid with some photovoltaic production.

On November 30th 2020 took place the defense of the Ph.D. Thesis entittled "Multistage Scenario Trees Generation for Renewable Energy Systems Optimization", authored by Ms. Marlyn D. Cuadrado Guevara and advised by prof. F.-Javier Heredia. In this thesis a new methodology to generate and validate probability scenario trees for multistage stochastic programming problems arising in two different energy systems with renewables are proposed. The first problem corresponds to the optimal bid to electricity markets of a virtual power plant that consists on a wind-power plant plus a battery storage energy systems. The second one is the optimal operation of a distribution grid with some photovoltaic production.

Multistage Scenario Trees Generation for Renewable Energy Systems Optimization

Mon, 11/30/2020 - 19:17 — admin| Publication Type | Thesis |

| Year of Publication | 2020 |

| Authors | Marlyn Dayana Cuadrado Guevara |

| Academic Department | Dept. of Statistics and Operations Research. Prof. F.-Javier Heredia, advisor. |

| Number of Pages | 194 |

| University | Universitat Politècnica de Catalunya |

| City | Barcelona |

| Degree | PhD Thesis |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Multistage Stochastic programming; phd thesis |

| Abstract | The presence of renewables in energy systems optimization have generated a high level of uncertainty in the data, which has led to a need for applying stochastic optimization to modelling problems with this characteristic. The method followed in this thesis is Multistage Stochastic Programming (MSP). Central to MSP is the idea of representing uncertainty (which, in this case, is modelled with a stochastic process) using scenario trees. In this thesis, we developed a methodology that starts with available historical data; generates a set of scenarios for each random variable of the MSP model; defines individual scenarios that are used to build the initial stochastic process (as a fan or an initial scenario tree); and builds the final scenario trees that are the approximation of the stochastic process. |

| URL | Click Here |

| Export | Tagged XML BibTex |

New paper published in Applied Energy

Fri, 04/03/2020 - 12:05 — admin

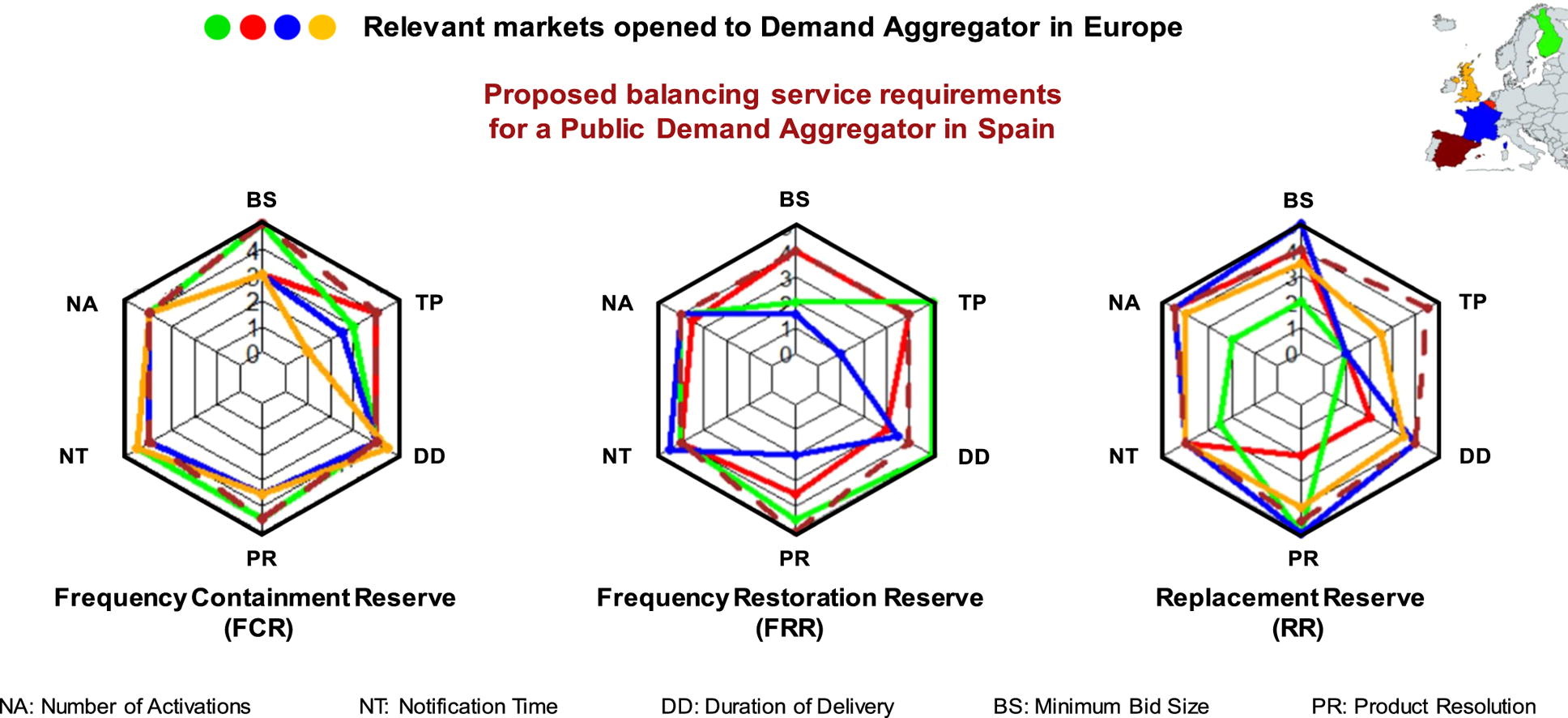

The paper entittled Critical evaluation of European balancing markets to enable the participation of Demand Aggregators has been published in Applied Energy This paper has been done in collaboration with the Institute for Energy Research of Catalonia (IREC). This study analyzes barriers and enablers of four European electricity markets and proposes a new market framework that would enhance Demand Aggregators' participation. Main barriers for Demand Aggregators have been identified and analyzed and a regulation scheme is proposed to enable Demand Aggregators participation. According to our results, small tertiary building aggregation is still not economic viable but existing municipal retailers could consider to extend their operations to Demand Aggregation.

The paper entittled Critical evaluation of European balancing markets to enable the participation of Demand Aggregators has been published in Applied Energy This paper has been done in collaboration with the Institute for Energy Research of Catalonia (IREC). This study analyzes barriers and enablers of four European electricity markets and proposes a new market framework that would enhance Demand Aggregators' participation. Main barriers for Demand Aggregators have been identified and analyzed and a regulation scheme is proposed to enable Demand Aggregators participation. According to our results, small tertiary building aggregation is still not economic viable but existing municipal retailers could consider to extend their operations to Demand Aggregation.

Critical evaluation of European balancing markets to enable the participation of Demand Aggregators

Fri, 04/03/2020 - 11:42 — admin| Publication Type | Journal Article |

| Year of Publication | 2020 |

| Authors | Mattia Barbero; Cristina Corchero; Lluc Canals; Lucia Igualada; F.-Javier Heredia |

| Journal Title | Applied Energy |

| Volume | 264 |

| Journal Date | 04/2020 |

| Publisher | Elsevier |

| ISSN Number | 0306-2619/ |

| Key Words | Demand Aggregator; Regulatory framework; Ancillary Services; Demand Response; Tertiary building management; research; paper |

| Abstract | European Directives are incentivizing consumers to play an active role in the electricity system and to collaborate to maintain its stability, which has been historically provided by large generation power plants. However, it is not easy for the System Operator to handle the coexistence of consumers and generators in the same markets. Under these circumstances, a new actor allows small residential and commercial consumers to participate in flexibility markets: The Demand Aggregator. However, balancing markets opened to Demand Aggregators still present several barriers that do not allow their practical participation. This study analyzes barriers and enablers of four European electricity markets and proposes a new market framework that would enhance Demand Aggregators’ participation. To validate the proposed market and to understand the economic potentials of aggregated small tertiary buildings, a Demand Aggregator is simulated using real building’s consumption data. Results show that technical requirements to participate in balancing markets such as the minimum bid size, the symmetricity of the offer and the product resolution strongly affect incomes for Demand Aggregators. However, neither in the proposed market, the creation of a Demand Aggregator whose business model is focused on small tertiary buildings does not seem realistic due to low incomes in comparison to the fixed costs necessary to enable Demand Response, especially if only the air conditioning system is considered. |

| URL | Click Here |

| DOI | 10.1016/j.apenergy.2020.114707 |

| Export | Tagged XML BibTex |

Generació d’arbres d’escenaris per a problemes d’oferta òptima en mercats d’electricitat

Mon, 08/19/2019 - 18:04 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2019 |

| Authors | Roger Serra Castilla |

| Director | F.- Javier Heredia; Marlyn D. Cuadrado |

| Tipus de tesi | BSc Thesis |

| Titulació | Grau en Estadística |

| Centre | Facultat de matemàtiques i Estadística |

| Data defensa | 01/2019 |

| Nota // mark | 9.0 |

| Key Words | teaching; scenario generation; scenario trees; electricity markets; BSc Thesis |

| Abstract | The electricity markets (EM) is a regulated system which allows producers and consumers to sell and buy energy at a given price that is fixed through an auction mechanism. Thanks to the tasks done by this system, the safe generation, transportation and distribution of electricity needed to satisfy the demand of the national population is assured. The electricity markets is made up of several markets, that can be considered either spot markets (day-ahead and intraday markets, whose trading commodity is energy) or ancillary services markets (the commodity negotiated is energy used to assure the stability of the energy delivering). On the other hand, interacting with the EM there is a wind power plant (WPP) which is in charge of the wind power energy production. A battery energy storage system (BESS) is usually associated to the WPP. The union of the WPP and the BESS is called virtual power plant (VPP). In this context, an optimization model can be presented: the WBVPP model (WPP+BESS Virtual Power Plant). The aim of this optimization model is the maximization of the expected value of the total profit of the VPP. To calculate this value, it is necessary to quantify the amount of wind power energy that fluctuates between the VPP and the EM, as well as the clearing prices of the auctions. The main purpose of this project is to obtain scenario trees using a dynamic generation algorithm in order to satisfy the need to solve, in a reasonable period of time, complex optimization problems of optimal supply of wind power plants in electricity markets. The scenarios trees that are going to be obtained include information regarding the production of wind power energy and the clearing prices of the auctions of the different studied electricity markets. In this study a scenario tree generation algorithm is presented, together with all the theoretical background needed to understand and assure a correct implementation of it, as well as the definition of the different agents that perform in the context of electricity markets. In addition to that, some data will be applied to this algorithm in order to obtain a representation of the scenario trees and to understand the interpretation of them. |

| DOI / handle | http://hdl.handle.net/2445/128065 |

| URL | Click Here |

| Export | Tagged XML BibTex |

A multistage stochastic programming model for the optimal bid of a wind producer

Wed, 07/11/2018 - 11:20 — admin| Publication Type | Conference Paper |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; J.-Anton Sánchez |

| Conference Name | 23th International Symposium on Mathematical Programming |

| Conference Date | 01-06/07/2018 |

| Conference Location | Bordeaux |

| Type of Work | contributed presentation |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming |

| Abstract | Abstract: Battery Energy Storage Systems (BESS) can be used by wind producers to improve the operation of wind power plants (WPP) in electricity markets. Associating a wind power plant with a BESS (the so-called Virtual Power Plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A new forecasting procedure for the random variables involved in stochastic programming model has been developed. The forecasting model is based on Time Factor Series Analysis (TFSA) and gives suitable results while reducing the dimensionality of the forecasting mode. The quality of the scenario trees generated using the TFSA forecasting models with real electricity markets and wind production data has been analysed through multistage VSS. |

| URL | Click Here |

| Export | Tagged XML BibTex |

New paper published in Computers and Operations Research

Tue, 06/12/2018 - 16:11 — admin

The work On optimal participation in the electricity markets of wind power plants with battery energy storage systems has been published in the journal Computers and Operations Research. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets hile taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. Preprint available at http://hdl.handle.net/2117/118479

The work On optimal participation in the electricity markets of wind power plants with battery energy storage systems has been published in the journal Computers and Operations Research. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets hile taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. Preprint available at http://hdl.handle.net/2117/118479

On optimal participation in the electricity markets of wind power plants with battery energy storage systems

Tue, 05/15/2018 - 16:25 — admin| Publication Type | Journal Article |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; Cristina Corchero |

| Journal Title | Computers and Operations Research |

| Volume | 96 |

| Pages | 316-329 |

| Journal Date | 08/2018 |

| Publisher | Elsevier |

| ISSN Number | 0305-0548 |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming; paper |

| Abstract | The recent cost reduction and technological advances in medium- to large-scale battery energy storage systems (BESS) makes these devices a true alternative for wind producers operating in electricity markets. Associating a wind power farm with a BESS (the so-called virtual power plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. What is more, recent studies have shown capital cost investment in BESS can be recovered only by means of such a VPP participating in the ancillary services markets. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. |

| URL | Click Here |

| DOI | 10.1016/j.cor.2018.03.004 |

| Preprint | http://hdl.handle.net/2117/118479 |

| Export | Tagged XML BibTex |

New paper published in Journal of Environmental Management

Sat, 01/20/2018 - 00:00 — admin The paper Stochastic optimal generation bid to electricity markets with emissions risk constraints has been published in the Journal of Environmental Management , Elsevier. This work investigates the influence of the emissions reduction plan and the incorporation of the medium-term derivative commitments in the optimal generation bidding strategy for the day-ahead electricity market. To address emission limitations, we have extended some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), thus leading to the new concept of Conditional Emission at Risk (CEaR). We analyze the economic implications for a GenCo that includes the environmental restrictions of this National Plan as well as the NERP's effects on the expected profits and the optimal generation bid. Preprint available at http://hdl.handle.net/2117/114024.

The paper Stochastic optimal generation bid to electricity markets with emissions risk constraints has been published in the Journal of Environmental Management , Elsevier. This work investigates the influence of the emissions reduction plan and the incorporation of the medium-term derivative commitments in the optimal generation bidding strategy for the day-ahead electricity market. To address emission limitations, we have extended some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), thus leading to the new concept of Conditional Emission at Risk (CEaR). We analyze the economic implications for a GenCo that includes the environmental restrictions of this National Plan as well as the NERP's effects on the expected profits and the optimal generation bid. Preprint available at http://hdl.handle.net/2117/114024.

A multistage stochastic programming model for the optimal management of wind-BESS virtual power plants

Fri, 07/07/2017 - 10:16 — admin| Publication Type | Conference Paper |

| Year of Publication | 2017 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado |

| Conference Name | WindFarms 2017 |

| Conference Date | 31/05-02/06/2017 |

| Conference Location | Madrid, Spain |

| Type of Work | Invited presentation |

| Key Words | research; wind farms; Ion-Li battery; multistage stochastic programming; stochastic programming |

| URL | Click Here |

| Export | Tagged XML BibTex |