Gas Natural - Fenosa

Multistage Scenario Trees Generation for Renewable Energy Systems Optimization

Mon, 11/30/2020 - 19:17 — admin| Publication Type | Thesis |

| Year of Publication | 2020 |

| Authors | Marlyn Dayana Cuadrado Guevara |

| Academic Department | Dept. of Statistics and Operations Research. Prof. F.-Javier Heredia, advisor. |

| Number of Pages | 194 |

| University | Universitat Politècnica de Catalunya-BarcelonaTech |

| City | Barcelona |

| Degree | PhD Thesis |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Multistage Stochastic programming; phd thesis |

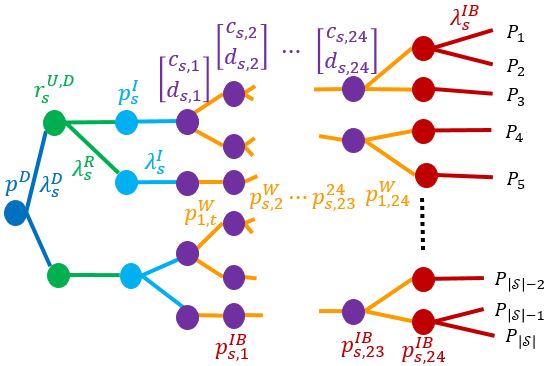

| Abstract | The presence of renewables in energy systems optimization have generated a high level of uncertainty in the data, which has led to a need for applying stochastic optimization to modelling problems with this characteristic. The method followed in this thesis is Multistage Stochastic Programming (MSP). Central to MSP is the idea of representing uncertainty (which, in this case, is modelled with a stochastic process) using scenario trees. In this thesis, we developed a methodology that starts with available historical data; generates a set of scenarios for each random variable of the MSP model; defines individual scenarios that are used to build the initial stochastic process (as a fan or an initial scenario tree); and builds the final scenario trees that are the approximation of the stochastic process. |

| URL | Click Here |

| Export | Tagged XML BibTex |

New paper published in Computers and Operations Research

Tue, 06/12/2018 - 16:11 — admin

The work On optimal participation in the electricity markets of wind power plants with battery energy storage systems has been published in the journal Computers and Operations Research. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets hile taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. Preprint available at http://hdl.handle.net/2117/118479

The work On optimal participation in the electricity markets of wind power plants with battery energy storage systems has been published in the journal Computers and Operations Research. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets hile taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. Preprint available at http://hdl.handle.net/2117/118479

On optimal participation in the electricity markets of wind power plants with battery energy storage systems

Tue, 05/15/2018 - 16:25 — admin| Publication Type | Journal Article |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; Cristina Corchero |

| Journal Title | Computers and Operations Research |

| Volume | 96 |

| Pages | 316-329 |

| Journal Date | 08/2018 |

| Publisher | Elsevier |

| ISSN Number | 0305-0548 |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming; paper |

| Abstract | The recent cost reduction and technological advances in medium- to large-scale battery energy storage systems (BESS) makes these devices a true alternative for wind producers operating in electricity markets. Associating a wind power farm with a BESS (the so-called virtual power plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. What is more, recent studies have shown capital cost investment in BESS can be recovered only by means of such a VPP participating in the ancillary services markets. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. |

| URL | Click Here |

| DOI | 10.1016/j.cor.2018.03.004 |

| Preprint | http://hdl.handle.net/2117/118479 |

| Export | Tagged XML BibTex |

New paper published in Journal of Environmental Management

Sat, 01/20/2018 - 00:00 — admin The paper Stochastic optimal generation bid to electricity markets with emissions risk constraints has been published in the Journal of Environmental Management , Elsevier. This work investigates the influence of the emissions reduction plan and the incorporation of the medium-term derivative commitments in the optimal generation bidding strategy for the day-ahead electricity market. To address emission limitations, we have extended some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), thus leading to the new concept of Conditional Emission at Risk (CEaR). We analyze the economic implications for a GenCo that includes the environmental restrictions of this National Plan as well as the NERP's effects on the expected profits and the optimal generation bid. Preprint available at http://hdl.handle.net/2117/114024.

The paper Stochastic optimal generation bid to electricity markets with emissions risk constraints has been published in the Journal of Environmental Management , Elsevier. This work investigates the influence of the emissions reduction plan and the incorporation of the medium-term derivative commitments in the optimal generation bidding strategy for the day-ahead electricity market. To address emission limitations, we have extended some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), thus leading to the new concept of Conditional Emission at Risk (CEaR). We analyze the economic implications for a GenCo that includes the environmental restrictions of this National Plan as well as the NERP's effects on the expected profits and the optimal generation bid. Preprint available at http://hdl.handle.net/2117/114024.

A multistage stochastic programming model for the optimal management of wind-BESS virtual power plants

Thu, 06/01/2017 - 16:26 — admin

A new multi-stage stochastic programming model for the optimal bid of a wind producer both in spot and

A new multi-stage stochastic programming model for the optimal bid of a wind producer both in spot and

ancillary services electricity markets has been presented inthe conference WindFarms 2017. We analyse the effect of the BESS and the

reserve market to the optimal bidding strategies of the VPP with real data

from the Iberian Electricity Market Operator (OMIE) and wind production data from Gas Natual - Fenosa. The complete presentation can be downloaded from here