electricity market

Two new master thesis on optimal operation of microgrids in electricity markets.

Thu, 11/27/2014 - 16:52 — admin

On June 2014 two new Master Thesis of the Master of Statistcs and Operations Research UPC-UB was presented

On June 2014 two new Master Thesis of the Master of Statistcs and Operations Research UPC-UB was presented

Dr. Cristina Corchero (IREC) and professor F.-Javier Heredia (GNOM) were the advisors of these two works developped at the facilities of the Catalonia Institute for Energy Research (IREC).

A stochastic programming model for the tertiary control of microgrids

Thu, 11/27/2014 - 16:48 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2014 |

| Authors | Leire Citores |

| Director | F.-Javier Heredia, Cristina Corchero |

| Tipus de tesi | MSc Thesis |

| Titulació | Master in Statistics and Operations research |

| Centre | Faculty of Mathematics and Statistics |

| Data defensa | 27/06/2014 |

| Nota // mark | 10 MH (A with Honours) |

| Key Words | research; teaching; microgrids, stochastic programming; scenario generation; wind generation; day-ahead electricity market; imbalances; MSc Thesis |

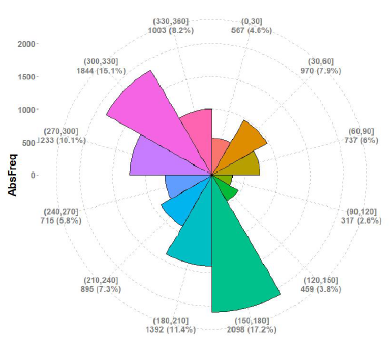

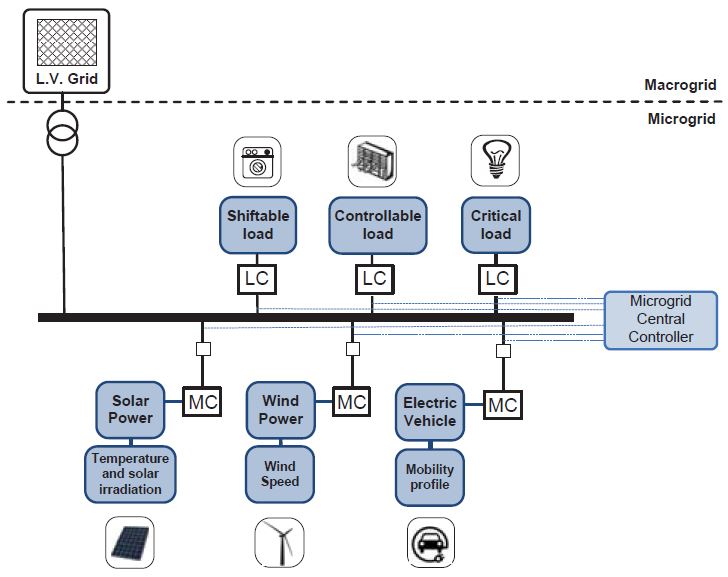

| Abstract | In this thesis a scenario-based two-stage stochastic programming model is proposed to solve a microgrid's tertiary control optimization problem taking into account some renewable energy resource s uncertainty as well uncertain energy deviation prices in the electricity market. Scenario generation methods for wind speed realizations are also studied. Results show that the introduction of stochastic programming represents an improvement over a deterministic model. |

| DOI / handle | http://hdl.handle.net/2099.1/23235 |

| URL | Click Here |

| Export | Tagged XML BibTex |

Energy Management System para una microrred domestica con participación en los servicios auxiliares de red

Thu, 11/27/2014 - 16:32 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2014 |

| Authors | Irune Etxarri Urtasun |

| Director | F.-Javier Heredia, Cristina Corchero |

| Tipus de tesi | MSc Thesis |

| Titulació | Master in Statistics and Operations Reseafrch |

| Centre | Faculty of Mathematics and Statistics |

| Data defensa | 27/06/2014 |

| Nota // mark | ** |

| Key Words | teaching; research; microgrids; stochastic programming; electricity market; secondary reserve; MSc Thesis |

| Abstract | En este proyecto se ha propuesto un modelo estocástico de dos etapas para la gestión de energía en una microrred doméstica, introduciendo la participación en el mercado de banda de regulación. El objetivo del modelo es determinar la potencia que se oferta al mercado diario, teniendo en cuenta la participación en el mercado de banda de regulación. Se ha introducido estocasticidad en los precios de este mercado y en los precios y probabilidades del requerimiento a subir y a bajar de la energía de regulación secundaria. Se han comparado los beneficios de la microrred en caso de participar o no en el mercado de banda de regulación, y se ha visto que la participación en dicho mercado produce grandes beneficios para sus usuarios. |

| DOI / handle | http://hdl.handle.net/2099.1/23233 |

| URL | Click Here |

| Export | Tagged XML BibTex |

Forecasting and optimization of wind generation in energy markets

Sat, 07/19/2014 - 11:53 — admin| Publication Type | Funded research projects |

| Year of Publication | 2014 |

| Authors | F.- Javier Heredia; Ma. Pilar Muñoz; Josep Anton Sánchez; Maria Dolores Márquez; Eugenio Mijangos; Marlyn Dayana Cuadrado Guevara |

| Type of participation | Principal Investigator (IP) |

| Duration | 01/2014-12/2016 |

| Call | PROGRAMA ESTATAL DE INVESTIGACIÓN, DESARROLLO E INNOVACIÓN ORIENTADA A LOS RETOS DE LA SOCIEDAD |

| Funding organization | Ministry of Economy and Competitivity, Government of Spain |

| Partners | Universitat Politècnica de Catalunya; Universitat Autònoma de Barcelona (Catalonia) Euskal Herriko Unibersitatea (Basc Country) Universidad Pontificia de Comillas (Madrid) Universidade Paulista Júlia de Mesquita Filho (Brasil) North Carolina State University (USA) Electrical Utilities: Iberdrola, Gas Natural - Fenosa. Research centers: Catalonia Institute for Energy Research. |

| Full time researchers | 4,5 |

| Budget | 49.000€ |

| Project code | MTM2013-48462-C2-1-R |

| Key Words | research; MTM2013-48462; forecasting, optimization, wind generation, energy markets; mineco; competitive; public; project; energy |

| Abstract | The coordinated project " Forecasting and Optimization of Wind Generation in Energy Markets" ( FOWGEM) aims at aplying a global approach to the problem of the optimal integration of the wind-enery generation of a generation company in the wholesale electricity market through the combination of statistical forecasting models, mathematical programming models for electricity markets and optimization algorithms. In the framework of the Spanish Strategy for Science and Technology and Innovation 2013-2020 this project contributes fundamentally to challenge 3, " safe, sustainable and clean energy ." Indeed, the forecasting and optimization models and procedures that will be developed in this project, are the necessary mechanisms to allow the competitive and safe integration of wind-energy generation in the multiple-markets based wholesale national energy production system. The FOWGEM project adopts an original and global approach to this problem that combines advanced methodologies in the area of statistics, mathematical modeling of energy markets and theoretical and computatitonal optimization that were developed in several previous projects of the Plan Nacional by the groups of the Universidad Politècnica de Catalunya and the Universidad Pontificia de Comillas . The main objecives of the project are:

|

| URL | Click Here |

| Export | Tagged XML BibTex |

New research reports on energy markets and smartgrids.

Fri, 01/24/2014 - 10:18 — admin-

Simona Sacripante, F.-Javier Heredia, Cristina Corchero, Stochastic optimal sale bid for a wind power producer,Research Report DR 2013/06 Dept. of Statistics and Operations Research. E-Prints UPC, Universitat Politècnica de Catalunya, 2013.

Simona Sacripante, F.-Javier Heredia, Cristina Corchero, Stochastic optimal sale bid for a wind power producer,Research Report DR 2013/06 Dept. of Statistics and Operations Research. E-Prints UPC, Universitat Politècnica de Catalunya, 2013.

-

F.-Javier Heredia, Julian Cifuentes, Cristina Corchero, Stochastic optimal generation bid to electricity markets with emission risk constraints, Research Report DR 2013/05 Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/20640. Universitat Politècnica de Catalunya, 2013.

-

Lucia Igualada, Cristina Corchero, Miguel Cruz-Zambrano, F.-Javier Heredia, Optimal energy management for a residential microgrid including a vehicle-to-grid system, Research Report DR 2013/04 Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/20642 . Universitat Politècnica de Catalunya, 2013.

Stochastic optimal sale bid for a wind power producer

Sun, 11/24/2013 - 19:02 — admin| Publication Type | Report |

| Year of Publication | 2013 |

| Authors | Simona Sacripante; F.-Javier Heredia; Cristina Corchero |

| Pages | 17 |

| Date | 11/2013 |

| Reference | Research report DR 2013/06, Dept. of Statistics and Operations Research. E-Prints UPC, Universitat Politècnica de Catalunya |

| Prepared for | Submitted |

| Key Words | research; electricity markets; wind generator; stochastic programming |

| Abstract | Wind power generation has a key role in Spanish electricity system since it is a native source of energy that could help Spain to reduce its dependency on the exterior for the production of electricity. Apart from the great environmental benefits produced, wind energy reduce considerably spot energy price, reaching to cover 16,6 % of peninsular demand. Although, wind farms show high investment costs and need an efficient incentive scheme to be financed. If on one hand, Spain has been a leading country in Europe in developing a successful incentive scheme, nowadays tariff deficit and negative economic conjunctures asks for consistent reductions in the support mechanism and demand wind producers to be able to compete into the market with more mature technologies. The objective of this work is to find an optimal commercial strategy in the production market that would allow wind producer to maximize their daily profit. That can be achieved on one hand, increasing incomes in daily and intraday markets, on the other hand, reducing deviation costs due to error in generation predictions. We will previously analyze market features and common practices in use and then develop our own sale strategy solving a two-stage linear stochastic optimization problem. The first stage variable will be the sale bid in the day–ahead market while second stage variables will be the offers to the six sessions of intraday market. The model is implemented using real data from a wind producer leader in Spain. |

| Export | Tagged XML BibTex |

Stochastic optimal generation bid to electricity markets with emission risk constraints.

Sun, 11/17/2013 - 19:22 — admin| Publication Type | Report |

| Year of Publication | 2013 |

| Authors | F.-Javier Heredia; Julian Cifuentes; Cristina Corchero |

| Pages | 21 |

| Date | 09/2013 |

| Reference | Research report DR 2013/04, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/20640. Universitat Politècnica de Catalunya |

| Prepared for | submitted |

| Key Words | research; OR in Energy; Stochastic Programming; Risk Management; Electricity market; Emission reduction |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a generation company (GenCo) in the current energy market framework. Environmental policy issues have become more and more important for fossil-fuelled power plants and they have to be considered in their management, giving rise to emission limitations. This work allows investigating the influence of the emission reduction plan, and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The Iberian Electricity Market (MIBEL) and the Spanish National Emission Reduction Plan (NERP) defines the environmental framework to deal with by the day-ahead market bidding strategies. To address emission limitations, some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), have been extended giving rise to the new concept of Conditional Emission-at-Risk (CEaR). This study offers to electricity generation utilities a mathematical model to determinate the individual optimal generation bid to the wholesale electricity market, for each one of their generation units that maximizes the long-run profits of the utility abiding by the Iberian Electricity Market rules, as well as the environmental restrictions set by the Spanish National Emissions Reduction Plan. The economic implications for a GenCo of including the environmental restrictions of this National Plan are analyzed, and the effect of the NERP in the expected profits and optimal generation bid are analyzed. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A new optimal electricity market bid model solved through perspective cuts

Fri, 09/06/2013 - 15:58 — admin| Publication Type | Report |

| Year of Publication | 2011 |

| Authors | Cristina Corchero; Eugenio Mijangos; F.-Javier Heredia |

| Pages | 25 |

| Date | 11/2011 |

| Reference | Research report DR 2011/04, Dept. of Statistics and Operations Research. E-Prints UPC, http://hdl.handle.net/2117/18368. Universitat Politècnica de Catalunya |

| Prepared for | Published by TOP |

| Key Words | research; electricity market; |

| Abstract | On current electricity markets the electrical utilities are faced with very sophisticated decision making problems under uncertainty. Moreover, when focusing in the shortterm management, generation companies must include some medium-term products that directly influence their short-term strategies. In this work, the bilateral and physical futures contracts are included into the day-ahead market bid following MIBEL rules and a stochastic quadratic mixed-integer programming model is presented. The complexity of this stochastic programming problem makes unpractical the resolution of large-scale instances with general purpose optimization codes. Therefore, in order to gain efficiency, a polyhedral outer approximation of the quadratic objective function obtained by means of perspective cuts (PC) is proposed. A set of instances of the problem has been defined with real data and solved with the PC methodology. The numerical results obtained show the efficiency of this methodology compared with standard mixed quadratic optimization solvers. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Improving Electricity Market Price Forecasting with Factor Models for the Optimal Generation Bid

Fri, 09/06/2013 - 14:58 — admin| Publication Type | Journal Article |

| Year of Publication | 2013 |

| Authors | M.Pilar Muñoz; Cristina Corchero; F.-Javier Heredia |

| Journal Title | International Statistical Review |

| Volume | 81 |

| Issue | 2 |

| Pages | 18 (289-306) |

| Start Page | 289 |

| Journal Date | August 2013 |

| Publisher | Wiley |

| ISSN Number | 1751-5823 |

| Key Words | research; paper; electricity market prices; short-term forecasting; stochastic programming; factor models; price scenarios; Q2 |

| Abstract | In liberalized electricity markets, the electricity generation companies usually manage their production by developing hourly bids that are sent to the day-ahead market. As the prices at which the energy will be purchased are unknown until the end of the bidding process, forecasting of spot prices has become an essential element in electricity management strategies. In this article, we apply forecasting factor models to the market framework in Spain and Portugal and study their performance. Although their goodness of fit is similar to that of autoregressive integrated moving average models, they are easier to implement. The second part of the paper uses the spot-price forecasting model to generate inputs for a stochastic programming model, which is then used to determine the company's optimal generation bid. The resulting optimal bidding curves are presented and analyzed in the context of the Iberian day-ahead electricity market. |

| URL | Click Here |

| DOI | 10.1111/insr.12014 |

| Preprint | http://hdl.handle.net/2117/3047 |

| Export | Tagged XML BibTex |

Stochastic optimal bid to electricity markets with environmental risk constraints

Wed, 03/27/2013 - 11:21 — admin| Publication Type | Tesis de Grau i Màster // BSc and MSc Thesis |

| Year of Publication | 2012 |

| Authors | Julian Cifuentes Rubiano |

| Director | F.-Javier Heredia |

| Tipus de tesi | MSc Thesis |

| Titulació | Master in Statistics and Operations Research |

| Centre | Faculty of Mathematics and Statistics |

| Data defensa | 21/12/2012 |

| Nota // mark | 9.5/10 |

| Key Words | teaching; stochastic programming; electricity markets; CO2 allowances; environment; emission limits; emission risk; CVaR; CEaR; modeling languages; MSc Thesis |

| Abstract | There are many factors that influence the day-ahead market bidding strategies of a generation company (GenCo) in the current energy market framework. Environmental policy issues have become more and more important for fossil-fuelled power plants and they have to be considered in their management, giving rise to emission limitations. This work allows to investigate the influence of both the allowances and emission reduction plan, and the incorporation of the derivatives medium-term commitments in the optimal generation bidding strategy to the day-ahead electricity market. Two different technologies have been considered: the coal thermal units, high-emission technology, and the combined cycle gas turbine units, low-emission technology. The Iberian Electricity Market and the Spanish National Emissions and Allocation Plans are the framework to deal with the environmental issues in the day-ahead market bidding strategies. To address emission limitations, some of the standard risk management methodologies developed for financial markets, such as Value-at-Risk (VaR) and Conditional Value at Risk (CVaR), have been extended. This study offers to electricity generation utilities a mathematical model to determinate the individual optimal generation bid to the wholesale electricity market, for each one of their generation units that maximizes the long-run profits of the utility abiding by the Iberian Electricity Market rules, the environmental restrictions set by the EU Emission Trading Scheme, as well as the restrictions set by the Spanish National Emissions Reduction Plan. The economic implications for a GenCo of including the environmental restrictions of these National Plans are analyzed and the most remarkable results will be presented.. The problem to be solved in this project will provide generationutilities with a mathematical tool to find the individual optimal generation bid for each one of theirgeneration units that maximizes the long-run profits of the utility abiding by the Iberian ElectricityMarket rules, the environmental restrictions of the EU Emission Trading Scheme and also by theSpanish National Emissions Reduction Plan |

| DOI / handle | http://hdl.handle.net/2099.1/17485 |

| URL | Click Here |

| Export | Tagged XML BibTex |