battery electricity storage system

Fri, 07/08/2022 - 12:10 — admin

Last July 4 2022 I was invited at the EURO 2022 conference , Aalto University, Espoo, near Helsinki, to present the work Multistage stochastic programming for the optimal bid of a wind-thermal power production pool with battery storage, which is a continuation of the MSc and PhD thesis of Mr. Ignasi Manyé and Ms. Marlyn D. Cuadrado respectively. This work tackles with an extensive study along a complete timespan of on year analyzing the benefits of a joint operation of a wind and thermal generation system in the elecrticity markets and bilateral contracts. Numerical results show that the total profit increases by 13% in average, but that it can be as high as 77%, with a reduction of the thermal operation costs of 61%.

Fri, 07/08/2022 - 11:26 — admin

| Publication Type | Conference Paper |

| Year of Publication | 2022 |

| Authors | F.-Javier Heredia; Ignasi Mañé; Marlyn Dayana Cuadrado Guevara |

| Conference Name | EURO 2022 |

| Conference Date | 03-06/07/2022 |

| Conference Location | Espoo, Finland. |

| Type of Work | Invited presentation |

| ISBN Number | 978-951-95254-1-9 |

| Key Words | research; multistage stochastic programming; virtual power plants; unit commitment |

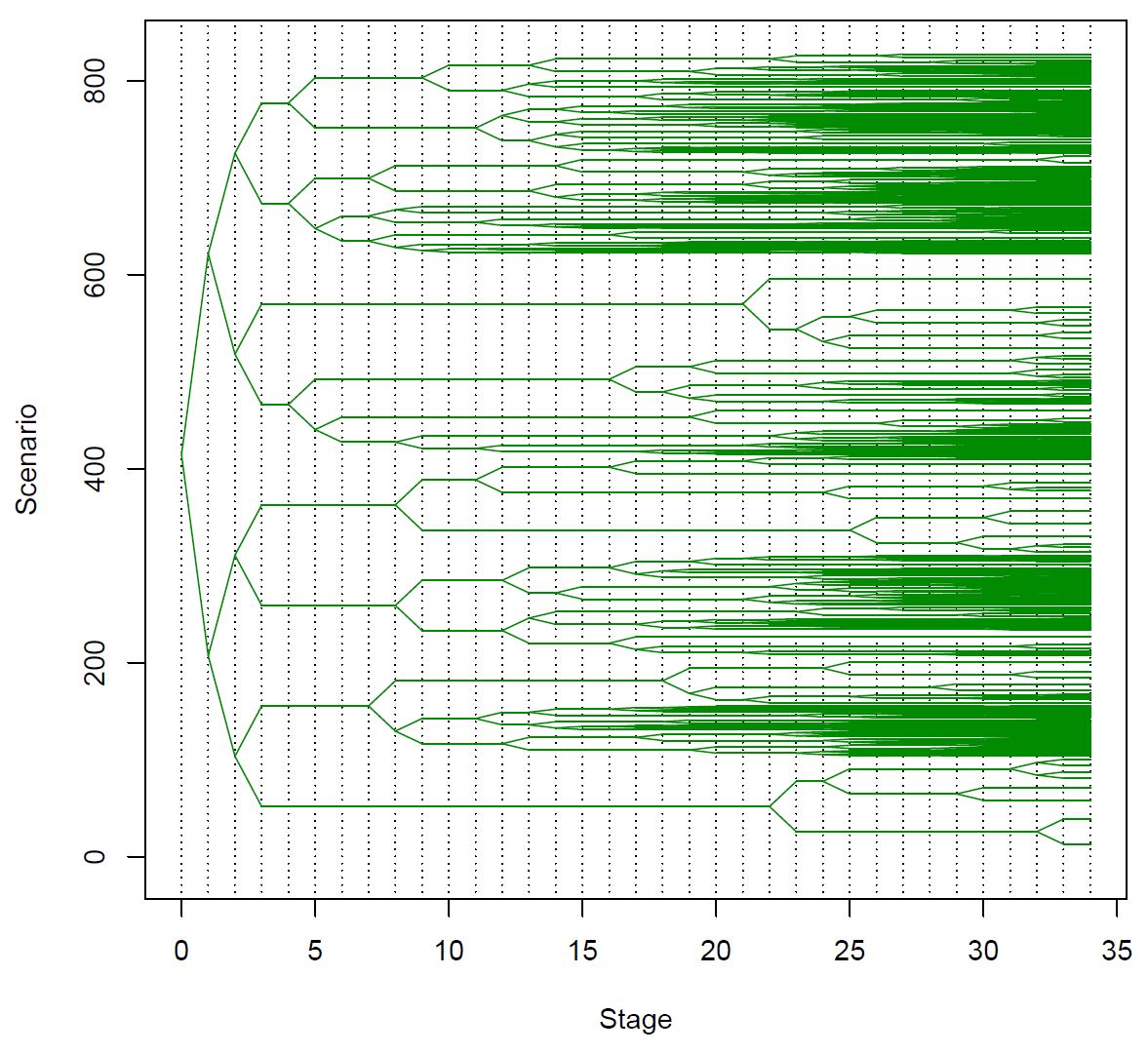

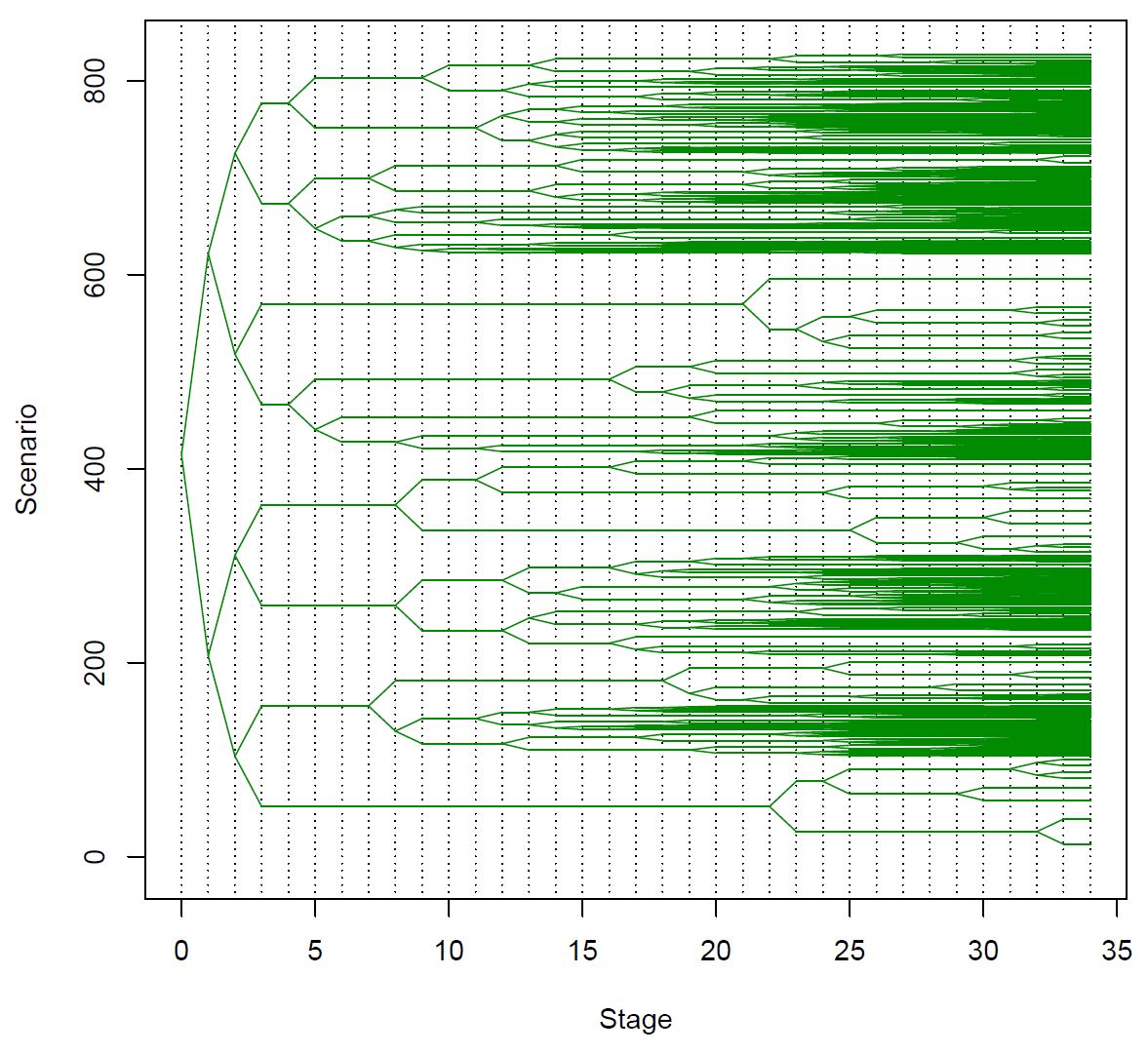

| Abstract | In this study we present a multistage stochastic programming model to find the joint optimal bid to electricity markets of a pool of dispatchable (thermal) and non-dispatchable (wind) production units with battery storage facilities. The assumption is that these programming units are operated by the same utility that, previous to the market clearing, has to dispatch some bilateral contracts with the joint production of the production pool. The multistage model mimics the multimarket bidding process in the Iberian Electricity Market (MIBEL). First, the utility has to decide how to cover the energy of the bilateral contracts with the available units. Second, the production capacity of each unit, not allocated to the bilateral contracts, must be offered to the seven consecutives spot markets (day-ahead and six intraday markets) plus the secondary reserve market (the most relevant ancillary services market). The stochasticity of the electricity clearing prices and the hourly generation of the wind-power units is considered. The stochastic process associated to this multistage decision-making process is modelled through multistage scenario trees with thirty-four stages that are built from forecasting models based on real data of the Iberian Electricity Market. The numerical results show the advantage of the joint operation of the pool of production units with an increase of the overall expected profits, mainly due to a strong reduction of the operational costs. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Tue, 07/13/2021 - 11:24 — admin

Tue, 07/13/2021 - 10:51 — admin

| Publication Type | Conference Paper |

| Year of Publication | 2021 |

| Authors | Marlyn Dayana Cuadrado Guevara; F.-Javier Heredia |

| Conference Name | 31st European Conference on Operational Research. |

| Conference Date | 11-14/07/2021 |

| Conference Location | Athens |

| Type of Work | Invited presentation |

| ISBN Number | ISBN 978-618-85079-1-3 |

| Key Words | research; multistage stochastich programming; virtual power plants; electricity markets; scenarios tree generation |

| Abstract | The presence of renewables in electricity markets optimization have generated a high level of uncertainty in the data, which has led to a need for applying stochastic optimization to model this kind of problems. In this work, we apply Multistage Stochastic Programming (MSP) using scenario trees to represent energy prices and wind power generation. We developed a methodology of two phases where, in the first phase, a procedure to predict the next day for each random parameter of the MSP models is used, and, in the second phase, a set of scenario trees are built through Forward Tree Construction Algorithm (FTCA) and a modified Dynamic Tree Generation with a Flexible Bushiness Algorithm (DTGFBA). This methodology was used to generate scenario trees for the Multistage Stochastic Wind Battery Virtual Power Plant model (MSWBVPP model), which were based on MIBEL prices and wind power generation of a real wind farm in Spain. In addition, we solved three di�erent case studies corresponding to three di�erent

hypotheses on the virtual power plant’s participation in electricity markets. Finally, we study the relative performance of the FTCA and DTGFBA scenario trees, analysing the value of the stochastic solution through the Forecasted Value of the Stochastic Solution (FVSS) and the classical VSS for the 366 daily instances of the MSWBVPP problem

spanning a complete year. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Mon, 11/30/2020 - 19:40 — admin

On November 30th 2020 took place the defense of the Ph.D. Thesis entittled " Multistage Scenario Trees Generation for Renewable Energy Systems Optimization", authored by Ms. Marlyn D. Cuadrado Guevara and advised by prof. F.-Javier Heredia. In this thesis a new methodology to generate and validate probability scenario trees for multistage stochastic programming problems arising in two different energy systems with renewables are proposed. The first problem corresponds to the optimal bid to electricity markets of a virtual power plant that consists on a wind-power plant plus a battery storage energy systems. The second one is the optimal operation of a distribution grid with some photovoltaic production.

Mon, 11/30/2020 - 19:17 — admin

| Publication Type | Thesis |

| Year of Publication | 2020 |

| Authors | Marlyn Dayana Cuadrado Guevara |

| Academic Department | Dept. of Statistics and Operations Research. Prof. F.-Javier Heredia, advisor. |

| Number of Pages | 194 |

| University | Universitat Politècnica de Catalunya |

| City | Barcelona |

| Degree | PhD Thesis |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Multistage Stochastic programming; phd thesis |

| Abstract | The presence of renewables in energy systems optimization have generated a high level of uncertainty in the data, which has led to a need for applying stochastic optimization to modelling problems with this characteristic. The method followed in this thesis is Multistage Stochastic Programming (MSP). Central to MSP is the idea of representing uncertainty (which, in this case, is modelled with a stochastic process) using scenario trees. In this thesis, we developed a methodology that starts with available historical data; generates a set of scenarios for each random variable of the MSP model; defines individual scenarios that are used to build the initial stochastic process (as a fan or an initial scenario tree); and builds the final scenario trees that are the approximation of the stochastic process. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Wed, 07/11/2018 - 11:20 — admin

| Publication Type | Conference Paper |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; J.-Anton Sánchez |

| Conference Name | 23th International Symposium on Mathematical Programming |

| Conference Date | 01-06/07/2018 |

| Conference Location | Bordeaux |

| Type of Work | contributed presentation |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming |

| Abstract | Abstract: Battery Energy Storage Systems (BESS) can be used by wind producers to improve the operation of wind power plants (WPP) in electricity markets. Associating a wind power plant with a BESS (the so-called Virtual Power Plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A new forecasting procedure for the random variables involved in stochastic programming model has been developed. The forecasting model is based on Time Factor Series Analysis (TFSA) and gives suitable results while reducing the dimensionality of the forecasting mode. The quality of the scenario trees generated using the TFSA forecasting models with real electricity markets and wind production data has been analysed through multistage VSS. |

| URL | Click Here |

| Export | Tagged XML BibTex |

Tue, 05/15/2018 - 16:25 — admin

| Publication Type | Journal Article |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; Cristina Corchero |

| Journal Title | Computers and Operations Research |

| Volume | 96 |

| Pages | 316-329 |

| Journal Date | 08/2018 |

| Publisher | Elsevier |

| ISSN Number | 0305-0548 |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming; paper |

| Abstract | The recent cost reduction and technological advances in medium- to large-scale battery energy storage systems (BESS) makes these devices a true alternative for wind producers operating in electricity markets. Associating a wind power farm with a BESS (the so-called virtual power plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. What is more, recent studies have shown capital cost investment in BESS can be recovered only by means of such a VPP participating in the ancillary services markets. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. |

| URL | Click Here |

| DOI | 10.1016/j.cor.2018.03.004 |

| Preprint | http://hdl.handle.net/2117/118479 |

| Export | Tagged XML BibTex |

Sat, 12/16/2017 - 00:00 — admin

| Publication Type | Conference Paper |

| Year of Publication | 2017 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; J.-Anton Sánchez |

| Conference Name | 4th International Conference on Optimization Methods and Software 2017 |

| Conference Date | 16-21/12/2017 |

| Conference Location | La Havana |

| Type of Work | Invited presentation |

| Key Words | multistage; VSS; wind-BESS VPP; wind power; energy storage; battery; research |

| Abstract | One of the objectives of the FOWGEN project (https://fowgem.upc.edu) was to study the economic feasibility and optimal operation of a wind-BESS Virtual Power Plant (VPP): In [1] an ex-post economic analysis shows the economic viability of a wind-BESS VPP thanks to the optimal operation in day-ahead and ancillary electricity markets; In [2] a new multi-stage stochastic programming model (WBVPP)for the optimal bid of a wind producer both in spot and ancillary services electricity markets is developed.

The work presented here extends the study in [2] with a new methodology to treat the uncertainty, based in forecasting models, and the study of the quality of the stochastic solution.

[1] F-Javier Heredia et al. Economic analysis of battery electric storage systems operating in electricity markets 12th International Conference on the European Energy Market (EEM15), 2015 DOI: 10.1109/EEM.2015.7216739.

[2] F-Javier Heredia et al. On optimal participation in the electricity markets of wind power plants with battery energy storage system. Submitted, under second revision. 2017. |

| URL | Click Here |

| Export | Tagged XML BibTex |

|

On November 30th 2020 took place the defense of the Ph.D. Thesis entittled "

On November 30th 2020 took place the defense of the Ph.D. Thesis entittled " The work

The work