multimarket

Master Thesis on electricity markets.

Wed, 12/01/2021 - 13:35 — adminOn November 2021 Mr. Ignasi Mañé presented the MsC thesis dissertation Multistage stochastic bid model for a wind-thermal power producer to opt for the master's degree in Statistics and Operations Research (UPC-UB), advised by prof. F.-Javier Heredia. This master thesis explores different multi-stage stochastic programming models for generation companies to find optimal bid functions in electric spot markets capturing the uncertainty of electric prices of different markets and financial products, and coupling together wind and thermal generation unit

Multistage Scenario Trees Generation for Renewable Energy Systems Optimization

Mon, 11/30/2020 - 19:17 — admin| Publication Type | Thesis |

| Year of Publication | 2020 |

| Authors | Marlyn Dayana Cuadrado Guevara |

| Academic Department | Dept. of Statistics and Operations Research. Prof. F.-Javier Heredia, advisor. |

| Number of Pages | 194 |

| University | Universitat Politècnica de Catalunya |

| City | Barcelona |

| Degree | PhD Thesis |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Multistage Stochastic programming; phd thesis |

| Abstract | The presence of renewables in energy systems optimization have generated a high level of uncertainty in the data, which has led to a need for applying stochastic optimization to modelling problems with this characteristic. The method followed in this thesis is Multistage Stochastic Programming (MSP). Central to MSP is the idea of representing uncertainty (which, in this case, is modelled with a stochastic process) using scenario trees. In this thesis, we developed a methodology that starts with available historical data; generates a set of scenarios for each random variable of the MSP model; defines individual scenarios that are used to build the initial stochastic process (as a fan or an initial scenario tree); and builds the final scenario trees that are the approximation of the stochastic process. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A multistage stochastic programming model for the optimal bid of a wind producer

Wed, 07/11/2018 - 11:20 — admin| Publication Type | Conference Paper |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; J.-Anton Sánchez |

| Conference Name | 23th International Symposium on Mathematical Programming |

| Conference Date | 01-06/07/2018 |

| Conference Location | Bordeaux |

| Type of Work | contributed presentation |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming |

| Abstract | Abstract: Battery Energy Storage Systems (BESS) can be used by wind producers to improve the operation of wind power plants (WPP) in electricity markets. Associating a wind power plant with a BESS (the so-called Virtual Power Plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A new forecasting procedure for the random variables involved in stochastic programming model has been developed. The forecasting model is based on Time Factor Series Analysis (TFSA) and gives suitable results while reducing the dimensionality of the forecasting mode. The quality of the scenario trees generated using the TFSA forecasting models with real electricity markets and wind production data has been analysed through multistage VSS. |

| URL | Click Here |

| Export | Tagged XML BibTex |

On optimal participation in the electricity markets of wind power plants with battery energy storage systems

Tue, 05/15/2018 - 16:25 — admin| Publication Type | Journal Article |

| Year of Publication | 2018 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; Cristina Corchero |

| Journal Title | Computers and Operations Research |

| Volume | 96 |

| Pages | 316-329 |

| Journal Date | 08/2018 |

| Publisher | Elsevier |

| ISSN Number | 0305-0548 |

| Key Words | research; Battery energy storage systems; Electricity markets; Ancillary services market; Wind power generation; Virtual power plants; Stochastic programming; paper |

| Abstract | The recent cost reduction and technological advances in medium- to large-scale battery energy storage systems (BESS) makes these devices a true alternative for wind producers operating in electricity markets. Associating a wind power farm with a BESS (the so-called virtual power plant (VPP)) provides utilities with a tool that converts uncertain wind power production into a dispatchable technology that can operate not only in spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, were forbidden to non-dispatchable technologies. What is more, recent studies have shown capital cost investment in BESS can be recovered only by means of such a VPP participating in the ancillary services markets. We present in this study a multi-stage stochastic programming model to find the optimal operation of a VPP in the day-ahead, intraday and secondary reserve markets while taking into account uncertainty in wind power generation and clearing prices (day-ahead, secondary reserve, intraday markets and system imbalances). A case study with real data from the Iberian electricity market is presented. |

| URL | Click Here |

| DOI | 10.1016/j.cor.2018.03.004 |

| Preprint | http://hdl.handle.net/2117/118479 |

| Export | Tagged XML BibTex |

A Multistage Stochastic Programming Model for the Optimal Bid of Wind-BESS Virtual Power Plants to Electricity Markets

Sat, 12/16/2017 - 00:00 — admin| Publication Type | Conference Paper |

| Year of Publication | 2017 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado; J.-Anton Sánchez |

| Conference Name | 4th International Conference on Optimization Methods and Software 2017 |

| Conference Date | 16-21/12/2017 |

| Conference Location | La Havana |

| Type of Work | Invited presentation |

| Key Words | multistage; VSS; wind-BESS VPP; wind power; energy storage; battery; research |

| Abstract | One of the objectives of the FOWGEN project (https://fowgem.upc.edu) was to study the economic feasibility and optimal operation of a wind-BESS Virtual Power Plant (VPP): In [1] an ex-post economic analysis shows the economic viability of a wind-BESS VPP thanks to the optimal operation in day-ahead and ancillary electricity markets; In [2] a new multi-stage stochastic programming model (WBVPP)for the optimal bid of a wind producer both in spot and ancillary services electricity markets is developed. The work presented here extends the study in [2] with a new methodology to treat the uncertainty, based in forecasting models, and the study of the quality of the stochastic solution. [1] F-Javier Heredia et al. Economic analysis of battery electric storage systems operating in electricity markets 12th International Conference on the European Energy Market (EEM15), 2015 DOI: 10.1109/EEM.2015.7216739. [2] F-Javier Heredia et al. On optimal participation in the electricity markets of wind power plants with battery energy storage system. Submitted, under second revision. 2017. |

| URL | Click Here |

| Export | Tagged XML BibTex |

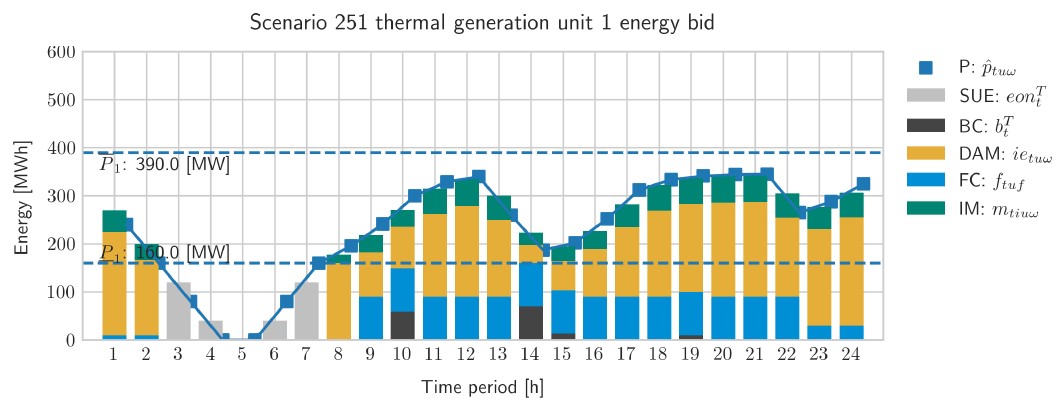

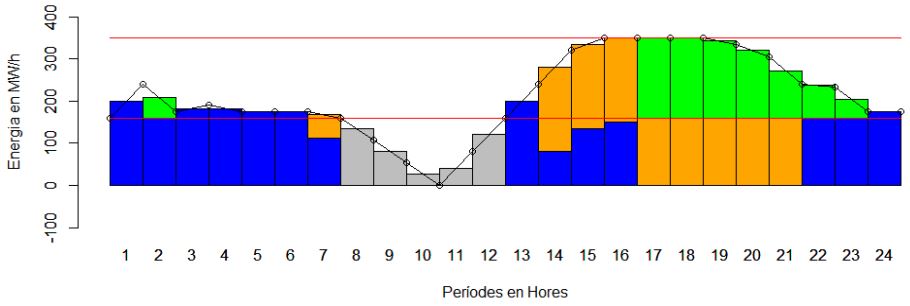

BSc Thesis on tight MILP formulation of the unit committment problem

Wed, 07/19/2017 - 11:56 — admin

L'alumne del grau de matemàtiques de l'FME Jordan Escandell ha llegit el treball fi de grau Caracterització de Formulacions Fortes del Problema Unit Commitment. Aquest projecte abordava la caracterització de formulacions fortes del problema Unit Commitment a partir de l'estudi de les diferents desigualtats proposades pels diferents autors així com la seva adaptació i possible millora en la modelització de certs problemes reals de mercats elèctrics. Els models d'optimització matemàtica obtinguts s'han implementat computacionalment i aplicat a la resolució de problemes reals d'oferta òptima a merctas elèctrics.

L'alumne del grau de matemàtiques de l'FME Jordan Escandell ha llegit el treball fi de grau Caracterització de Formulacions Fortes del Problema Unit Commitment. Aquest projecte abordava la caracterització de formulacions fortes del problema Unit Commitment a partir de l'estudi de les diferents desigualtats proposades pels diferents autors així com la seva adaptació i possible millora en la modelització de certs problemes reals de mercats elèctrics. Els models d'optimització matemàtica obtinguts s'han implementat computacionalment i aplicat a la resolució de problemes reals d'oferta òptima a merctas elèctrics.

A multistage stochastic programming model for the optimal management of wind-BESS virtual power plants

Fri, 07/07/2017 - 10:16 — admin| Publication Type | Conference Paper |

| Year of Publication | 2017 |

| Authors | F.-Javier Heredia; Marlyn D. Cuadrado |

| Conference Name | WindFarms 2017 |

| Conference Date | 31/05-02/06/2017 |

| Conference Location | Madrid, Spain |

| Type of Work | Invited presentation |

| Key Words | research; wind farms; Ion-Li battery; multistage stochastic programming; stochastic programming |

| URL | Click Here |

| Export | Tagged XML BibTex |

On the optimal participation in electricity markets of wind power plants with battery energy storage systems

Mon, 07/18/2016 - 18:43 — admin| Publication Type | Conference Paper |

| Year of Publication | 2016 |

| Authors | F.-Javier Heredia; Cristina Corchero; Marlyn D. Cuadrado |

| Conference Name | 28th European Conference on Operational Research |

| Series Title | Conference Handbook |

| Pagination | 322 |

| Conference Date | 3-6/07/2016 |

| Conference Location | Poznan, Poland |

| Type of Work | contributed presentation. |

| Key Words | research; VPP; wind generation; battery energy storage system; stochastic programming; electricity market; optimal bid |

| Abstract | The recent cost reduction and technologic advances in medium to large scale Battery Energy Storage Systems (BESS) makes these devices a real choice alternative for wind producers operating in electricity markets. The association of a wind power farm with a BESS (the so called Virtual Power Plant VPP) provides utilities with a tool to turn the uncertainty wind power production into a dispatchable technology enabled to operate not only in the spot and adjustment markets (day-ahead and intraday markets) but also in ancillary services markets that, up to now, was forbidden to non-dispatchable technologies. Even more, recent studies have shown that the capital cost investment in BESS can only be recovered through the participation of such a VPP in the ancillary services markets. We present in this study a stochastic programming model to find the optimal participation of a VPP to the day-ahead market and secondary reserve markets (the most relevant ancillary service market) where the uncertainty in wind power generation and markets prices (day-ahead ancillary services) has been considered. A case study with real data from the Iberian Electricity Market is presented. |

| URL | Click Here |

| Export | Tagged XML BibTex |

A stochastic programming model for the tertiary control of microgrids

Thu, 09/03/2015 - 10:25 — admin| Publication Type | Proceedings Article |

| Year of Publication | 2015 |

| Authors | Leire Citores; Cristina Corchero; F.-Javier Heredia |

| Conference Name | 12th International Conference on the European Energy Market (EEM15) |

| Pagination | 1-6 |

| Conference Start Date | 19-22/05/2015 |

| Publisher | IEEE |

| Conference Location | Lisbon, Portugal. |

| ISBN Number | 978-1-4673-6691-5 |

| Key Words | Microgrids; Optimization; Production; Stochastic processes; Uncertainty; Wind power generation; Wind speed; energy system optimization; microgrid; scenario generation; stochastic programming; paper; research |

| Abstract | In this work a scenario-based two-stage stochastic programming model is proposed to solve a microgrid's tertiary control optimization problem taking into account some renewable energy resource's uncertainty as well as uncertain energy deviation prices in the electricity market. Scenario generation methods for wind speed realizations are also studied. Results show that the introduction of stochastic programming represents a significant improvement over a deterministic model. |

| URL | Click Here |

| DOI | 10.1109/EEM.2015.7216761 |

| Export | Tagged XML BibTex |

Parallel Proximal Bundle Methods for Stochastic Electricity Market Problems

Fri, 07/17/2015 - 13:02 — admin| Publication Type | Conference Paper |

| Year of Publication | 2015 |

| Authors | F.-Javier Heredia; Antonio Rengifo |

| Conference Name | 27th European Conference on Operational Research |

| Conference Date | 12-15/07/2015 |

| Conference Location | Glasgow, UK. |

| Type of Work | invited |

| Key Words | research; MTM2013-48462-C2-1; mixed-integer nonlinear programming; proximal bundle methods; multimarket electricity problems; parallelism |

| Abstract | The use of stochastic programming to solve real instances of optimal bid problems in electricity market usually implies the solution of large scale mixed integer nonlinear optimization problems that can't be tackled with the available general purpose commercial optimisation software. In this work we show the potential of proximal bundle methods to solve large scale stochastic programming problems arising in electricity markets. Proximal bundle methods was used in the past to solve deterministic unit commitment problems and are extended in this work to solve real instances of stochastic optimal bid problems to the day-ahead market (with embedded unit commitment) with thousands of scenarios. A parallel implementation of the proximal bundle method has been developed to take profit of the separability of the lagrangean problem in as many subproblems as generation bid units. The parallel proximal bundle method (PPBM) is compared against general purpose commercial optimization software as well as against the perspective cuts algorithm, a method specially conceived to deal with quadratic objective function over semi-continuous domains. The reported numerical results obtained with a workstation with 32 threads show that the commercial software can’t find a solution beyond 50 scenarios and that the execution times of the proposed PPBM are as low as a 15% of the execution time of the perspective cut approach for problems beyond 800 scenarios. |

| URL | Click Here |

| Export | Tagged XML BibTex |